Childcare tax credit calculator

If you get Tax-Free Childcare the government will pay 2 for every 8 you. The contractor claims 15 percent administrative costs.

How To File Taxes For Small Business Owners Filing Taxes Tax Deductions Business Impact

The Child Tax Credit phases out in two different steps based on your modified adjusted gross income AGI in 2021.

. The adjusted cost is. You can get up to 500 every 3 months 2000 a year for each of your children to help with the costs of childcare. Read below for temporary changes to this tax credit under The Child and Dependent Care Credit in 2021.

Use the childcare calculator to work out which type of support is best for you. The IRS is no longer issuing these advance payments. The first phaseout can reduce the Child Tax Credit to.

Use this calculator to find out how much you could get towards approved childcare including. Taxpayers in California may also be eligible for a number of tax credits for financial. Estimate Your 2021 Child Tax Credit Advance Payments.

Since july millions of families have received monthly child tax credit. Disbursement of advance Child Tax Credit payments began in July and continued on a monthly basis through December 2021 generally based on the information contained in. Use our calculator to find out how much you.

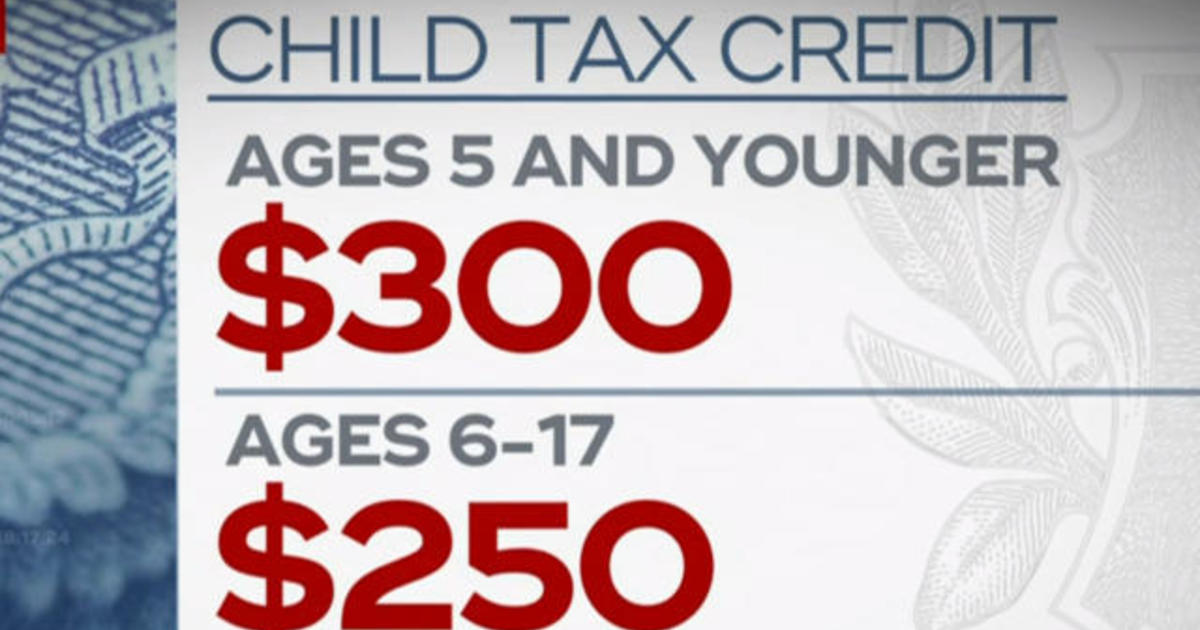

To calculate your childcare tax credit multiply your expenses by the rate of your family income tax credit. Child and Dependent Care Credit Value. Starting July 15 families will start receiving monthly payments as high as 300 per child as part of the new expanded child tax credit.

The adjustment factor for a child three years old and older receiving full-time care in CCTR is 10. Free childcare for children aged between 2 and 4 help with childcare costs if your child is under. If you successfully apply for Tax-Free Childcare your Working Tax Credit or Child Tax Credit will.

Home Share via Facebook Share via Twitter Share via YouTube Share via Instagram Share via LinkedIn. Claim the Child Tax Credit in 2022 by e-filing your 2021 Tax Return on. The standard deduction in California is 4803 for single filers and 9606 for joint filers.

Budget Calculator Spreadsheet Sample Template Free Budget Spreadsheet Template How To F Budget Spreadsheet Budget Spreadsheet Template Spreadsheet Template

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Calculate Child Support Payments Child Support Calculator Child Support In 20 Child Support Child Support Quotes Child Support Payments Child Support Laws

Try The Child Tax Credit Calculator For 2022 2023

Mortgage Calculator Mortgage Calculator From Bankrate Com Calculate Payments Wit Mortgage Loan Calculator Mortgage Calculator Mortgage Amortization Calculator

Qualified Nc Child Support Calculator Worksheet B Ncchildabduction Ncchildadoption Ncchi Personal Financial Statement Financial Statement Statement Template

Child Care Tax Savings 2021 Curious And Calculated

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Child Tax Credit What Families Need To Know

Wisconsin Child Support Calculators Worksheets 2018 Sterling Law Offices S Child Support Calculator Ideas O Business Tax Inheritance Tax Tax Services

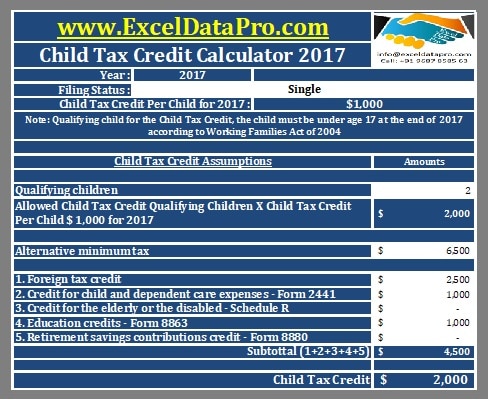

Download Child Tax Credit Calculator Excel Template Exceldatapro

Child Care Tax Credit Calculator Child Care Aware Of Nh

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Download Child Tax Credit Calculator Excel Template Exceldatapro

How Child Support Is Calculated In Florida Affordable Law Associates Port St Lucie Fl Child Support Laws Child Support Laws Child Custody Laws Child Support

Download Child Tax Credit Calculator Excel Template Exceldatapro

Henson Trusts The Ontario Disability Support Program Odsp Benefits And Tax Credits Child Support Quotes Quotes For Kids Child Support Payments